Management Strategy

Medium-term Management Strategy (FYE March 2027-2029)

Toward Becoming a Company Creating the Future through Resource Circulation

The Mitsubishi Materials Group has been implementing measures under the Medium-term Management Strategy FY2031, working to fulfill Our Commitment: "For people, society and the earth, circulating resources for a sustainable future." However, the external environment has changed significantly from our initial assumptions due to factors such as shifts in automotive and semiconductor-related markets and substantial worsening of purchasing conditions (TC/RC) for copper concentrates.

In response, we have undertaken Fundamental Structural Reforms to ensure profitability even under adverse conditions, reviewed our management strategy for the fiscal year ending March 2027 and beyond, and formulated a new Medium-term Management Strategy ("New Strategy"). Through initiatives under each measure of the new Medium-Term Management Strategy, we aim to become a company committed to creating the future through resource circulation, contributing to a sustainable society while further enhancing corporate value.

Overview of the Medium-term Management Strategy

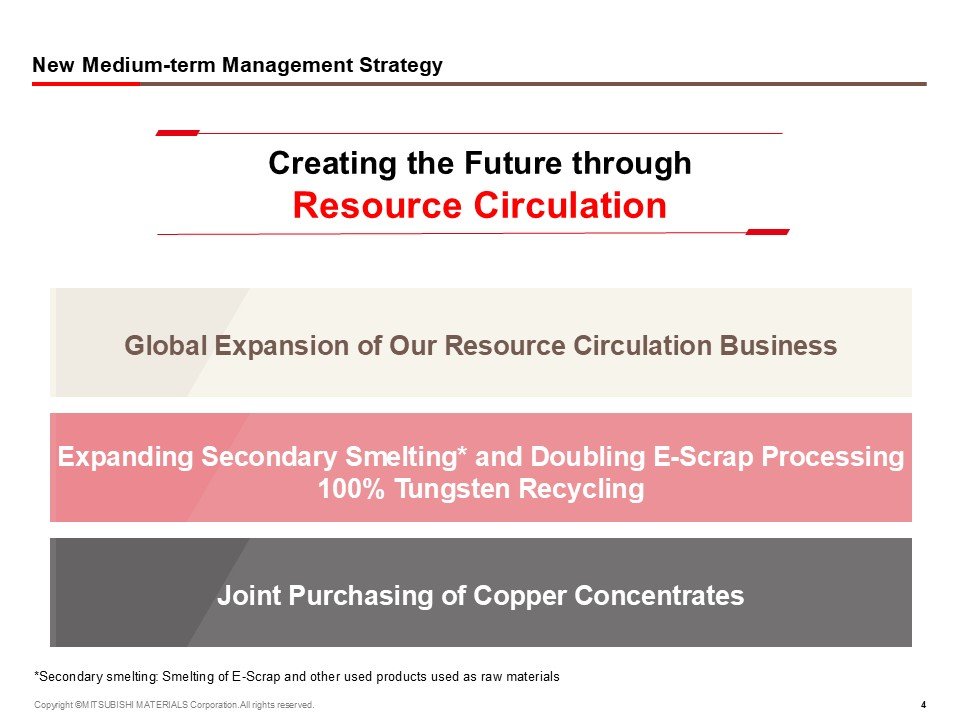

In the new Medium-term Management Strategy, the basic policy is to become a company committed to "creating the future through resource circulation." Through this approach, we aim to maximize the use of limited resources and convert waste materials into new value, thereby achieving both a reduction in environmental impact and the creation of economic value.

As growth strategies and important measures, we will pursue global expansion of the resource circulation business, expanding secondary smelting and doubling E-Scrap processing, achieving a 100% tungsten recycling rate, and joint purchasing of copper concentrates. These initiatives are designed to maximize corporate value.

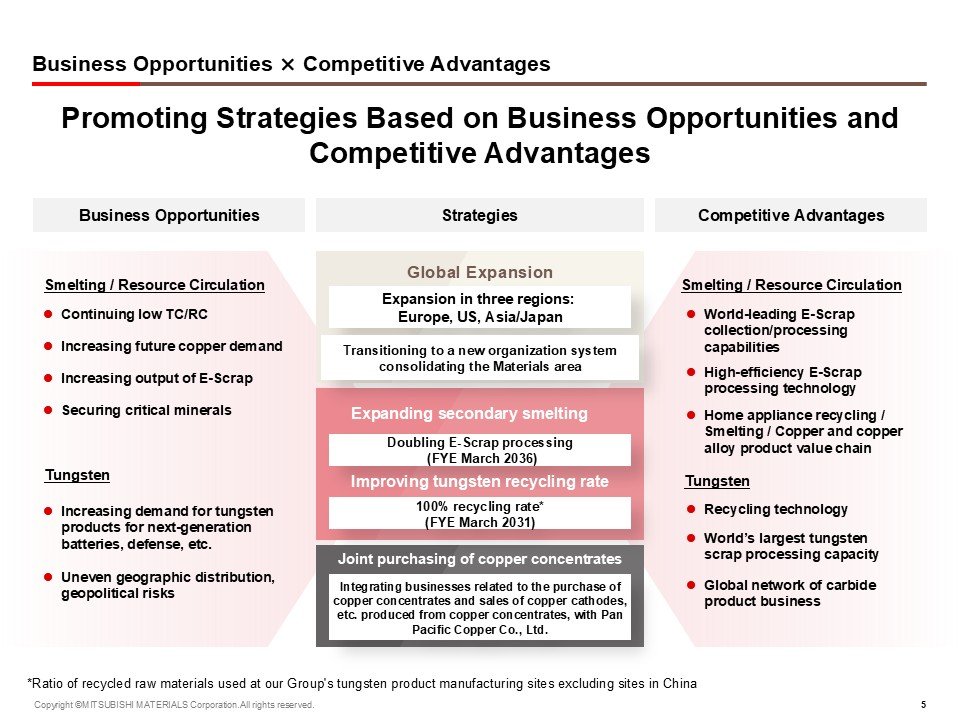

Business Opportunities and Competitive Advantages

While long-term copper demand is expected to increase due to decarbonization and digitalization, the supply of copper concentrates is limited, making recycled materials such as E-Scrap increasingly important. In addition to possessing world-class E-Scrap collection and processing capabilities and advanced technology, our Company also has a value chain that extends from home appliance recycling to copper and copper alloy products. Leveraging these strengths, we aim to double our E-Scrap processing volume globally by the fiscal year ending March 2036.

For tungsten, a rare metal, demand is expected to rise in next-generation batteries and the defense industry, while primary raw material reserves are unevenly distributed. With the acquisition of H.C. Starck in the fiscal year ended March 2025, we have obtained the world's largest scrap processing capacity. By further expanding this capacity and raising the share of recycled raw materials at our tungsten production sites to 100% by the fiscal year ending March 2031, we will meet growing demand while also enhancing profitability.

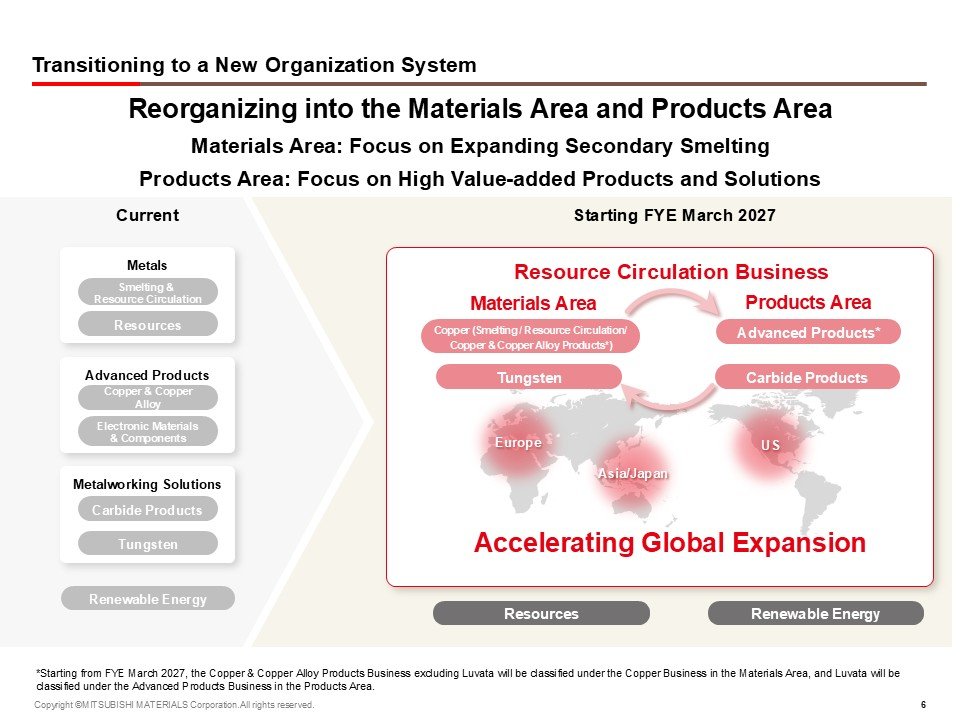

Transition to a New Organizational Structure

Under this reorganization, the process from collecting and processing recycled raw materials to producing copper, copper alloys, and tungsten materials will be positioned as the "Materials Area," while Advanced Products Business and Carbide Products Business further downstream will be positioned as the "Products Area." Both areas will accelerate global expansion. In the Materials Area, we will promote the expansion of secondary smelting, resource circulation loops, and tungsten recycling by integrating related businesses. The mission of the Products Area is to enhance profitability through the provision of high value-added products and solutions.

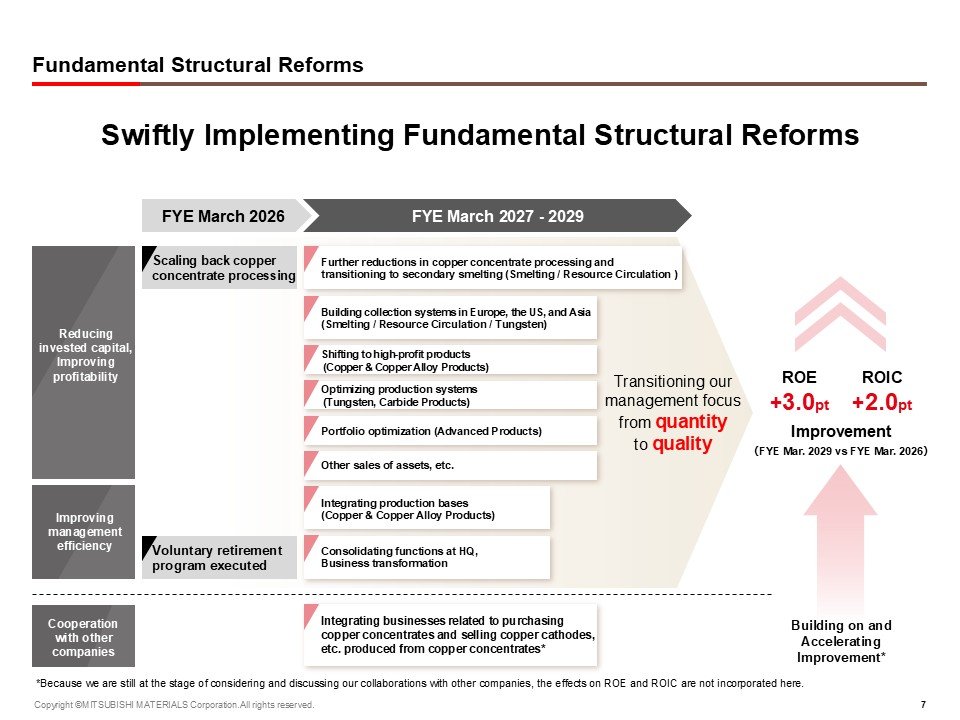

Fundamental Structural Reform

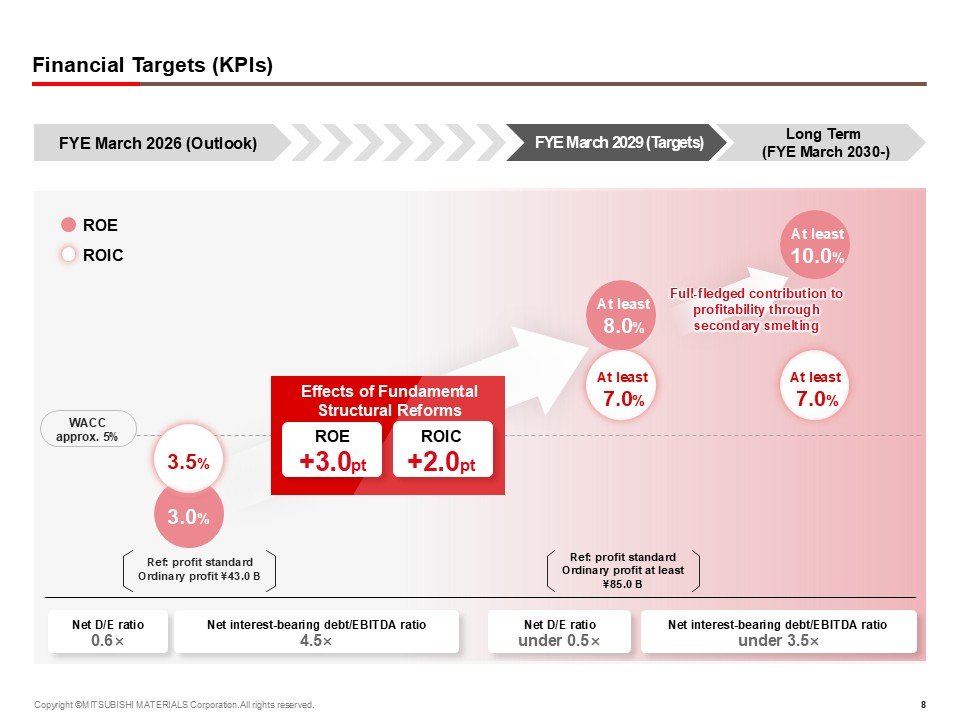

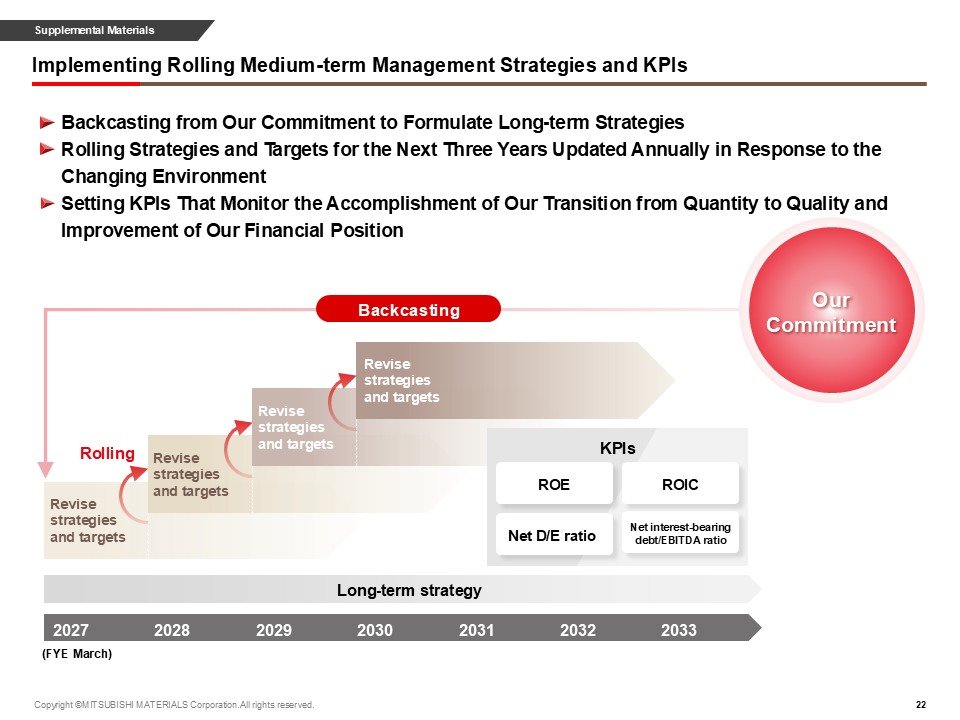

Management focus is shifting from quantity to quality, with swift implementation of measures such as transitioning from copper concentrate processing to secondary smelting, optimizing the production system and business portfolio, and consolidating head office functions. As a result, ROE is expected to improve by three percentage points and ROIC by two percentage points in the fiscal year ending March 2029 compared to the fiscal year ending March 2026.

Financial Targets (KPIs)

For the fiscal year ending March 2029, the financial targets are as follows:

- ROE: at least 8%

- ROIC: at least 7%

- Net D/E ratio: below 0.5 times

- Net interest-bearing debt to EBITDA ratio: below 3.5 times

Beyond 2030, the long-term target is to achieve ROE of at least 10%, aiming for sustainable growth.

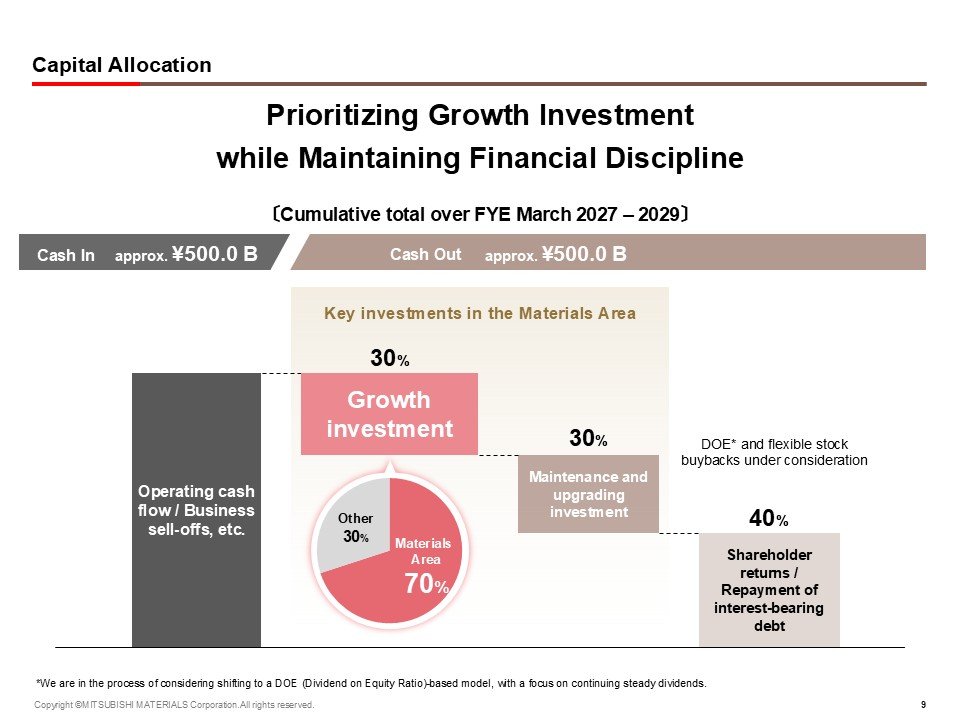

Capital Allocation

Over the three-year period from the fiscal year ending March 2027 to the fiscal year ending March 2029, we anticipate a total cash inflow of approximately ¥500.0 billion. To ensure financial discipline, a portion of these funds will be used to repay interest-bearing debt. However, our top priority will be to invest in growth, particularly in the Materials Area of our Resource Circulation Business.

Regarding shareholder returns, we are considering a transition to a Dividend on Equity (DOE)-based policy, with a strong focus on maintaining stable dividends. For share repurchases, we will continue to take a flexible approach, taking into account our cash flow, stock price, and overall financial discipline.

Business Strategy

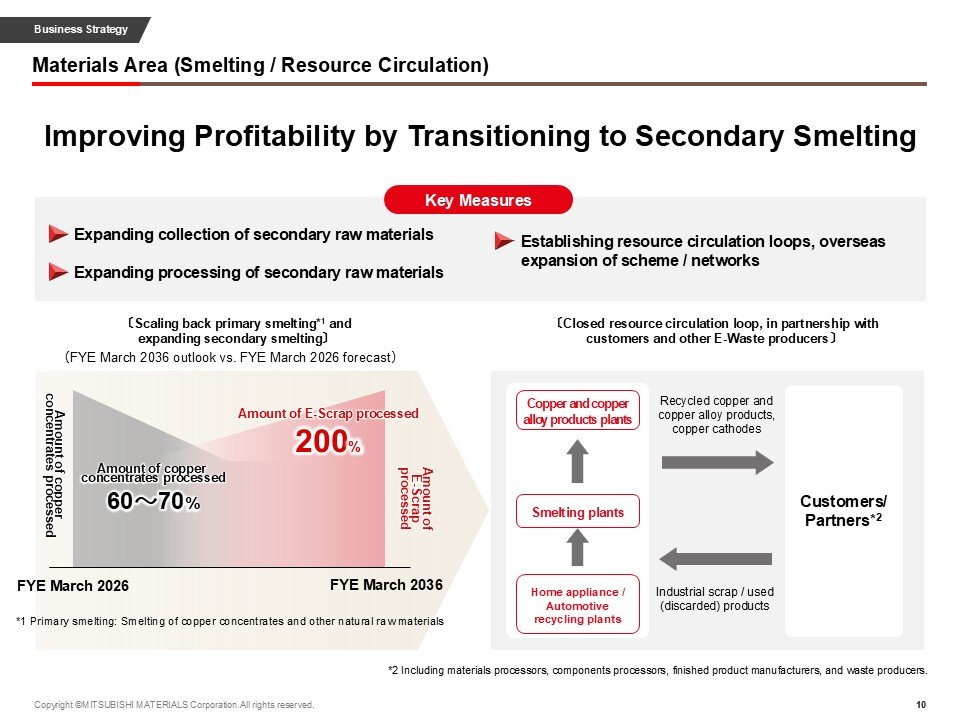

Materials Area (Smelting Business / Resource Recycling Business)

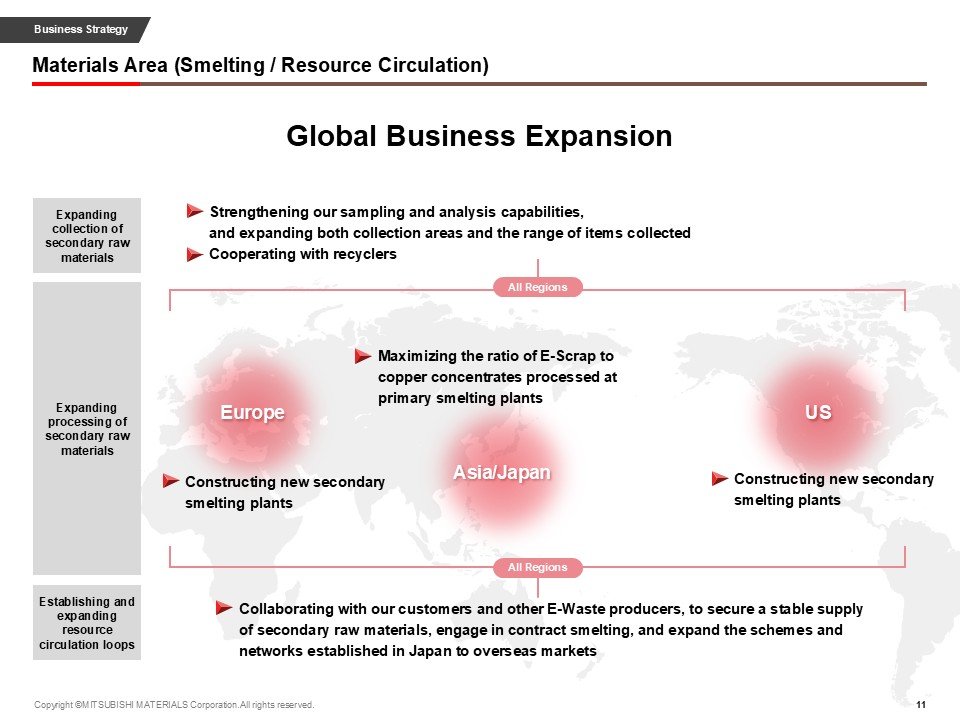

In the Materials Area, for copper-related resource circulation, we seek to achieve improved profitability by advancing the shift toward secondary smelting. Copper concentrate processing volumes are planned to be reduced to 60-70% of the fiscal year ending March 2026 level, while E‑Scrap collection and processing are targeted to double by the fiscal year ending March 2036. Resource circulation loops are being built and expanded to ensure traceability and secure a stable supply of recycled copper cathodes and recycled copper and copper‑alloy products.

For global expansion, efforts include strengthening sampling and analysis technologies and promoting collaboration with recyclers to enhance collection capabilities. In Japan, investments are underway to expand E‑Scrap processing capacity and accelerate technology development to maximize the ratio of E‑Scrap processing relative to copper concentrate processing. In Europe, Mitsubishi Materials Europe B.V. is considering the establishment of a new secondary smelting plant, and in the United States, the Exurban Project is progressing toward the construction of a new secondary smelting plant. In addition, resource circulation schemes and networks established in Japan are being extended to overseas markets to build robust global resource circulation loops.

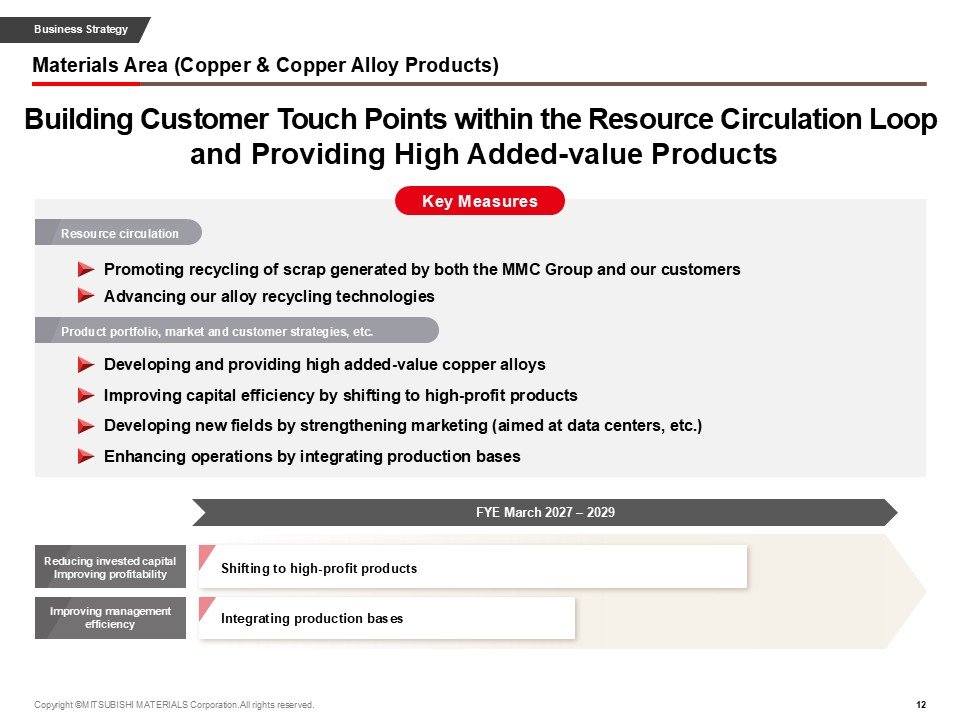

Materials Area (Copper & Copper Alloy Products Business)

The Copper & Copper Alloy Products Business plays an important role as a point of contact with customers within the resource circulation loop. Efforts are directed toward promoting the recycling of customer-generated scrap and advancing alloy recycling technologies. In addition, the development of high value-added copper alloys is being pursued to meet evolving market needs, along with initiatives to explore new business opportunities in emerging fields such as data centers.

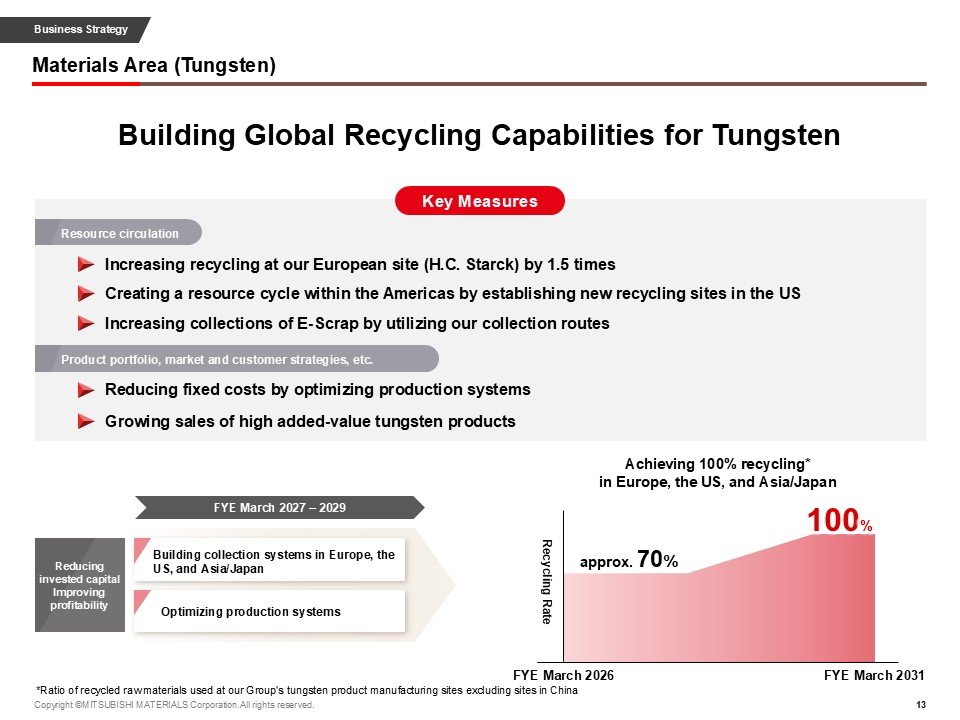

Materials Area (Tungsten Business)

H.C. Starck plans to increase recycling capacity by 1.5 times and establish new recycling bases in the United States. The E-Scrap collection network will be utilized, and efforts will be made to strengthen the collection of used carbide products through the Carbide Products Business. The objective is to achieve a 100% recycling rate at tungsten product manufacturing sites in Europe, the United States, and Asia including Japan by the fiscal year ending March 2031. In addition, plans include expanding sales of high-value tungsten products, such as powder for electronic components, and ensuring a stable supply for carbide products.

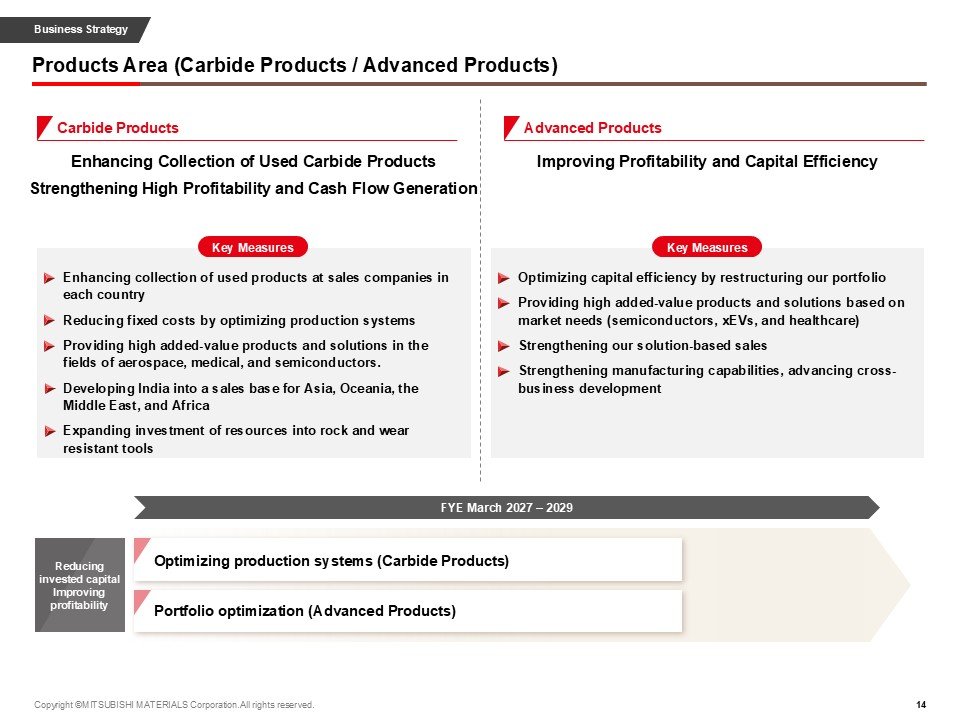

Products Area (Carbide Products Business / Advanced Products Business)

Carbide Products Business:

In the Carbide Products Business, efforts to promote tungsten resource recycling include strengthening the collection of used products through global sales companies. As part of fundamental structural reforms, we are reducing fixed costs by optimizing the production system. On the sales side, we will advance the provision of higher value-added products and solutions to the aerospace, medical, and semiconductor sectors. From a regional perspective, sales expansion is promoted from India as a strategic hub.

Advanced Products Business:

In the Advanced Products Business, capital efficiency is optimized through portfolio restructuring. Profitability and efficiency are further enhanced by providing high value-added products and solutions in semiconductors, electric vehicles (xEVs), and healthcare, while promoting cross-functional development across the business.

Resources / Renewable Energy

Resources Business:

In the Resources Business, priority is placed on securing the stable procurement of copper concentrates and enhancing the profitability of existing assets. At the Mantoverde Copper Mine, plans are underway to expand plant processing capacity. Increasing the equity copper share relative to total copper concentrate processing volume is expected to mitigate the impact of low TC/RC. In addition, technology development is being advanced for the recovery of valuable by-products such as cobalt and scandium.

Renewable Energy Business:

In the Renewable Energy Business, a long-term goal has been set to generate renewable energy equivalent to the Company's own electricity consumption, contributing to the realization of a decarbonized society. Development of new sites is being advanced with a particular focus on geothermal energy.

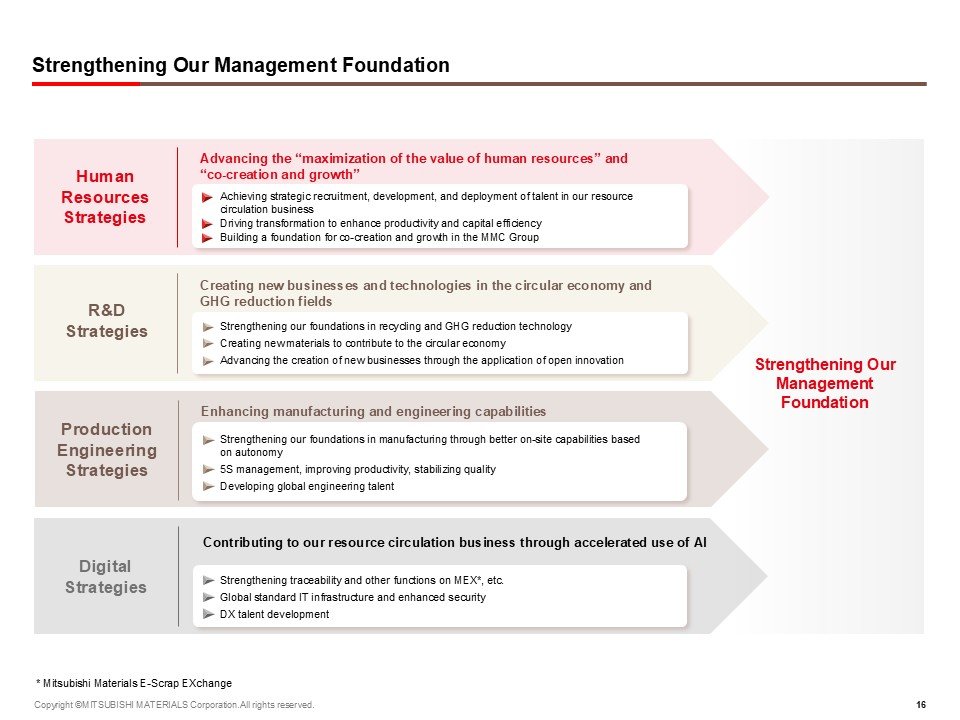

Strengthening the Management Foundation

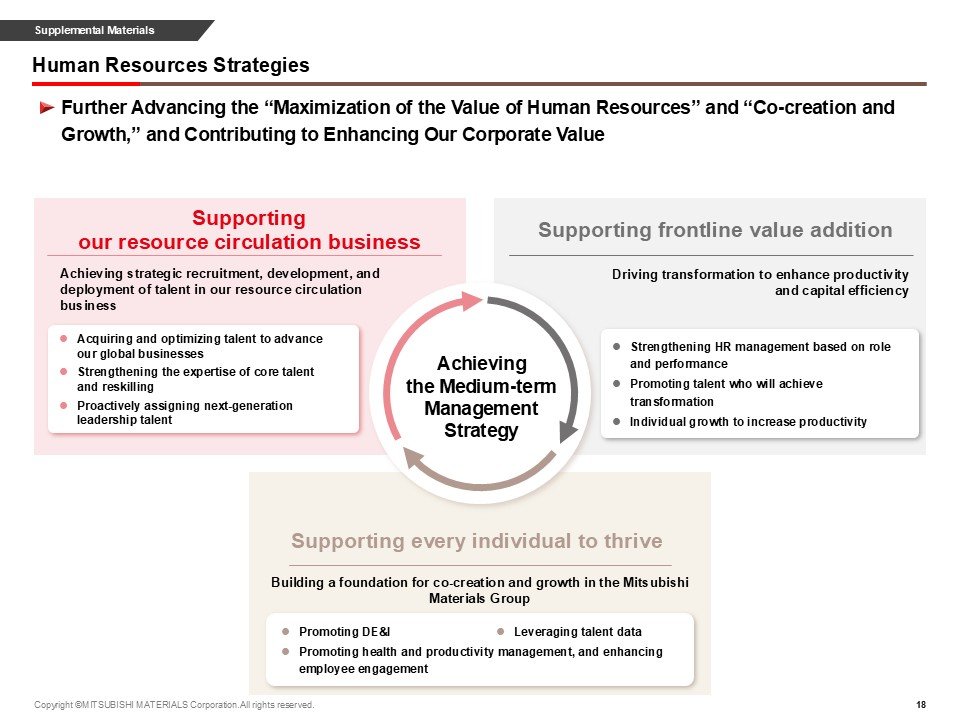

Human Resources Strategies:

Strategic recruitment, development, and assignment of talent are being implemented to support the global expansion of the resource circulation business. In the course of advancing fundamental structural reforms, initiatives focus on fostering individuals capable of driving transformation to enhance productivity and capital efficiency, while building a foundation for co-creation and growth across the Group.

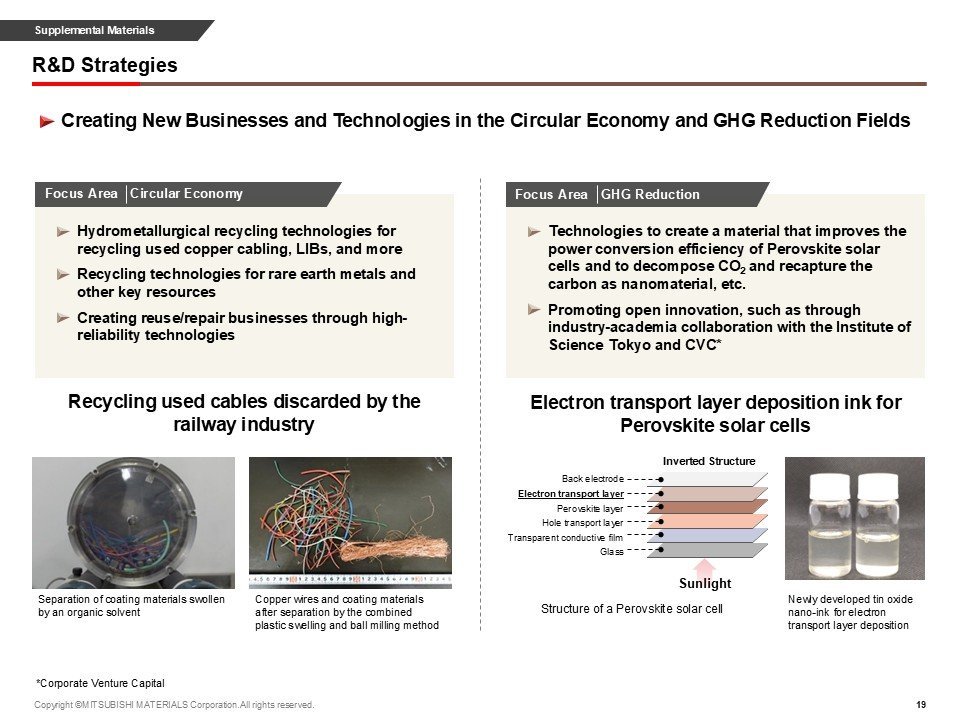

R&D Strategies:

The creation of new businesses and technologies is pursued in the fields of the circular economy and GHG reduction.

Production Engineering Strategies:

Strengthening manufacturing and engineering capabilities to enhance competitiveness and support continuous innovation.

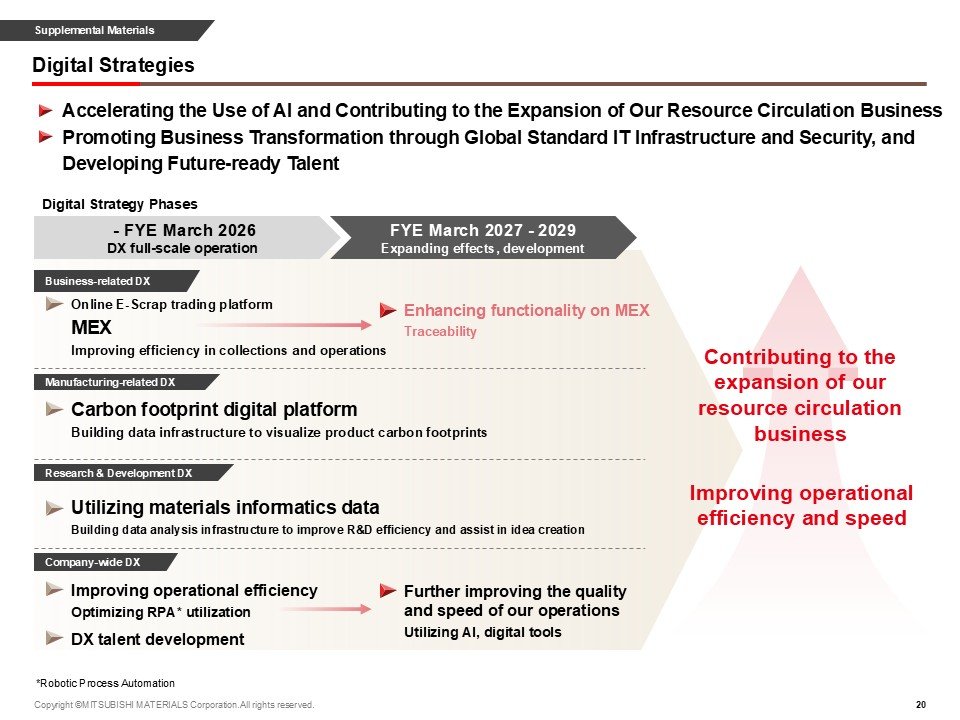

Digital Strategies:

Enhancing global-standard IT infrastructure, strengthening security, and accelerating the utilization of AI to support the expansion of the resource circulation business.

Supplemental Materials

FY2027-2029 Medium-term Management Strategy

Previous plans

FY2024-2031 Medium-term Management Strategy

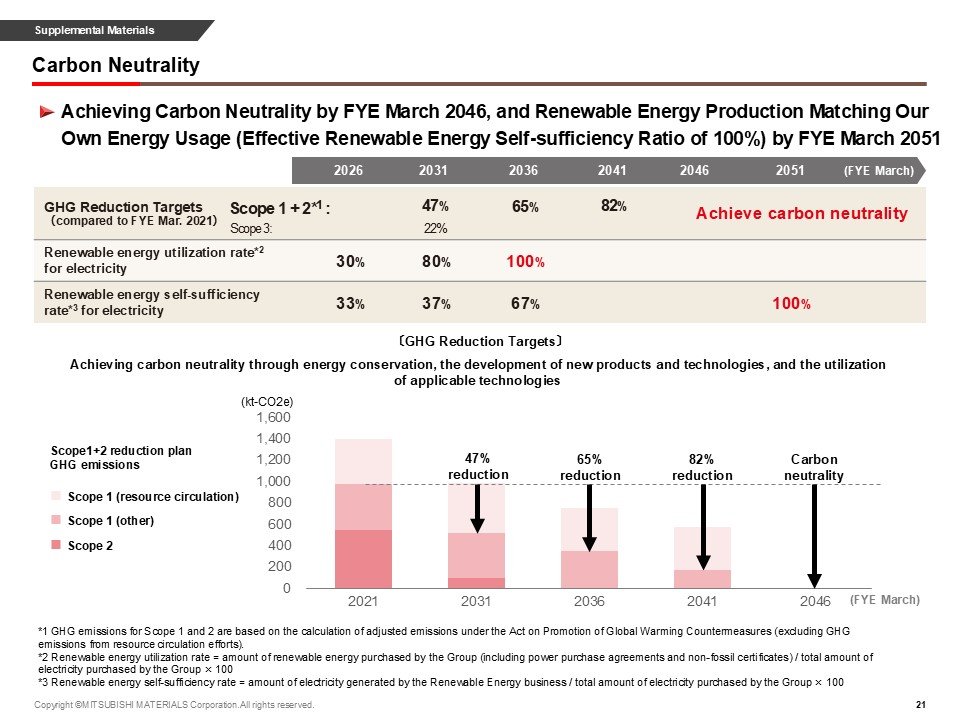

Notice Concerning Revision of Greenhouse Gas Emissions Reduction Target (2024.7.31)

Notice Concerning Revision of Greenhouse Gas Emissions Reduction Target (2023.7.26)

Briefing Materials on the Medium-term Management Strategy FY2031 (1.1MB) (2023.2.16)

Summary of Explanation and Q&A on Medium-term Management Strategy briefing (4,840KB) (2023.2.16)

Notice Regarding Medium-term Management Strategy FY2031 (1.4MB) (2023.2.10)