Corporate Governance

Basic Approach

We have, based on the corporate philosophy of the Group, vision, values, code of conduct, our commitment and the Basic Policy on Corporate Governance* established by the Board of Directors, developed trust with all stakeholders related to the Company and its subsidiaries (hereinafter, the "Group"), such as shareholders and investors as well as employees, customers, client or supplier companies, creditors and local communities, and also develop our corporate governance.

Among the governance systems under the Companies Act, we have chosen to be a Company with a Nomination Committee, etc., and by separating supervision and execution, will strengthen the Board of Directors' management supervisory functions, improve the transparency and fairness of management and accelerate business execution and decision making.

We acknowledge the enhancement of corporate governance to be one of the most important management issues, and continuously make efforts to improve our corporate governance.

* We have prepared the "Basic Policy on Corporate Governance," as a compilation of the basic approach to and framework of corporate governance.

Basic Policy on Corporate Governance (June 25, 2025) (PDF: 132KB)

Corporate Governance System

Overview of Corporate Governance

Among the governance systems under the Companies Act, we have chosen to be a Company with a Nomination Committee, etc., and by separating supervision and execution, will strengthen the Board of Directors' management supervisory functions, improve the transparency and fairness of management and accelerate business execution and decision making.

As the Group is an integrated business entity supplying basic materials and elements indispensable to the world, and is involved in recycling business and renewable energy business, we adopted an in-house company system so as to facilitate and appropriately execute business operations.

The functions and duties of the Board of Directors shall be as follows:

- - Upon delegation by shareholders, the Board of Directors shall indicate the direction of its management and make an effort to enhance the Group's medium- to long-term corporate value by, for example, engaging in freewheeling and constructive discussion on management policies and management reforms;

- - The Board of Directors shall determine matters that may have a serious impact on management, such as management policies and management reforms, in accordance with the provisions of laws, the Articles of Incorporation and the Board of Directors Rules;

- - The Board of Directors shall accelerate decision-making in business execution by delegating the authority over business execution to an appropriate extent to Executive Officers in accordance with the provisions of the Board of Directors Rules, etc. so that Executive Officers may assume the responsibility and authority to make decisions and execute business in response to changes in the business environment; and

- - The state of Group governance and the progress of the execution of duties, including the progress of the management strategy, shall be reported by Executive Officers to and supervised by the Board of Directors on a periodic basis.

The Board of Directors is comprised of Ten (10) Directors (including seven (7) Outside Directors), and the Chair of the Board of Directors is performed by Naoki Ono.

(Nomination Committee)

The Nomination Committee determines the policy for nomination of candidates for Director and dismissal of Directors and the content of proposals for the appointment and dismissal of Directors to be submitted to the General Meeting of Shareholders. In addition to this, the Committee deliberates on the appointment and dismissal of Executive Officers, etc. in response to inquiries from the Board of Directors and reports back to the Board of Directors thereof. Furthermore, the Committee deliberates on the candidates for the successor of the Chief Executive Officer with the development plans and exercises supervision to ensure that the development of successor candidates is performed appropriately. The Committee deliberates on candidates for the next Chief Executive Officer in response to the inquiries from the Board of Directors and reports back to the Board.

Majority of the Nomination Committee members shall be Independent Outside Directors, and the Chair shall be performed by an Independent Outside Director. The Nomination Committee is comprised of three (3) Directors (All are Outside Directors), and the Chair is Tatsuo Wakabayashi (Independent Outside Director).

(Audit Committee)

The Audit Committee audits the legality and validity of duties performed by Directors and Executive Officers, via audits either using internal control systems or directly by the Audit Committee member selected by the Audit committee.

Majority of the Audit Committee members shall be Independent Outside Directors, and the Chair shall be performed by an Independent Outside Director.

The Audit Committee is comprised of four (4) Directors (including three (3) Outside Directors), and the Chair is Kazuhiko Takeda (Independent Outside Director).

(Remuneration Committee)

The Remuneration Committee establishes policies for determining individual remuneration for Directors and Executive Officers, and determines the individual remuneration to be received by Directors and Executive Officers based on such policies.

Majority of the Remuneration Committee members shall be Independent Outside Directors, and the Chair shall be performed by an Independent Outside Director. The Remuneration Committee is comprised of three (3) Directors (All are Outside Directors), and the Chair is Koji Igarashi (Independent Outside Director).

(Sustainability Committee)

The Sustainability Committee shall review policies on sustainability issues and others after being consulted by the Board of Directors, and submit the details to the Board.

Majority of the Sustainability Committee members shall be Independent Outside Directors, and the Chair shall be performed by an Independent Outside Director. Currently, the Sustainability Committee is comprised of three (3) Directors (All are Outside Directors), and the Chair is Nozomi Sagara (Independent Outside Director).

Each committee will allow Outside Directors other than committee members to participate as observers to eliminate information gaps among Outside Directors, and will also have the CEO and others attend committee meetings as necessary to hear explanations and opinions.

(Executive Officer)

Executive Officers execute business in accordance with the prescribed segregation of duties, based on the delegation of authority from the Board of Directors.

The Company has seven (7) Executive Officers, of which the Chief Executive Officer Tetsuya Tanaka, and Managing Executive Officer Nobuhiro Takayanagi, are elected as Representative Executive Officers upon the decision of the Board of Directors.

(Strategic Management Committee)

Following the delegation of authority from the Board of Directors, the Strategic Management Committee reviews and determines important matters concerning the management of the entire Group. The Strategic Management Committee consists of the Chief Executive Officer and the Executive Officers in charge of each department of the Corporate. The Chief Executive Officer serves as the chair of the committee.

Nomination of Candidates for Director, Dismissal of Directors, and the Election and Dismissal of Executive Officers

(a) Policy for Nomination of Candidates for Director and Dismissal of Directors

Our basic approach to the structure of the Board of Directors, which fulfills the roles of determining the direction of management and exercising supervision over the progress of business execution, is to ensure that it comprises a diverse range of human resources with different expert knowledge, experience, and other qualities. In particular, the Nomination Committee will consider candidates for Outside Director to ensure that they comprise individuals who possess experience and knowledge in corporate management (business similar to or different from the Group's business, etc.) and organizational management, and individuals who possess broad and advanced expert knowledge and extensive experience in relation to finance and accounting, legal affairs, production engineering, research and development, sales and marketing, or international relations, etc.

In light of the basic policy on the structure mentioned above, the Nomination Committee will nominate and select individuals who satisfy the following requirements as candidates for Director, regardless of individual attributes concerning gender, nationality and race, etc.:

- - An individual of exceptional insight and character;

- - An individual with a strong sense of ethics and a law-abiding spirit; and

- - An individual who can properly fulfill his or her duties concerning the exercise of supervision over the management of the Company and the determination of the direction of management.

Further, with respect to candidates for Independent Outside Director, the Nomination Committee will nominate and select individuals who satisfy the following requirement in addition to the above requirements:

- - An individual who has no material interest in the Group and who can remain independent. The specific selection of personnel shall be decided after deliberation by the Nomination Committee.

If a Director falls under any of the following events, the Nomination Committee may determine the content of the proposal to be presented to the General Meeting of Shareholders for the dismissal of such Director.

- - When there is a serious violation of laws and regulations or the Articles of Incorporation by a Director;

- - When a Director commits serious misconduct in the performance of his/her duties;

- - When there is a lack of the judgmental capacity that a Director should have or when the capacity to reason is notably inadequate; or

- - When a Director will likely be unable to attend the Board of Directors meetings for a considerably long period of time.

The Company considers that an Outside Director is not independent if he or she falls under any of the conditions listed below in addition to meeting the standards for independence established by Tokyo Stock Exchange, Inc.

1. An individual who falls under or has fallen under any of items (1) or (2) below, either presently or in the past:

- (1) An executive or non-executive Director (excluding Outside Director) of the Company; or

- (2) An executive or non-executive Director of the Company's subsidiary.

2. An individual who falls under any of items (1) through (5) below:

- (1) An executive of a client or supplier company of the Company, whose value of transactions amounted to 2% or more of the consolidated net sales of the Company or the client or supplier company as of the end of the previous fiscal year;

- (2) A person who received, as a professional or consultant, etc., consideration of not less than 10 million yen from the Company in the previous fiscal year, excluding his/her consideration as a Director;

- (3) An executive of an organization that received a donation of not less than 10 million yen from the Company in the previous fiscal year;

- (4) A shareholder who directly or indirectly holds at least 10% of the total number of voting rights of the Company or an executive of such shareholder; or

- (5) The Company's Accounting Auditor or its employee, etc.

3. An individual who has fallen under any of items (1) to (5) of 2 above at any time in the past three (3) years:

4. A close relative of any of the persons listed in item (1) or (2) of 1 above, items (1) to (5) of 2 above, or 3 above (excluding unimportant persons); or

5. A person who has served as the Company's Outside Director for a period of more than eight (8) years.

(b) Policy for Election and Dismissal of Executive Officers

In electing Executive Officers responsible for the execution of business tasks, individuals who satisfy the following requirements will be elected, regardless of individual attributes concerning gender, nationality and race, etc.:

- - An individual of exceptional insight and character;

- - An individual with a strong sense of ethics and a law-abiding spirit; and

- - An individual well-versed in management and the business activities of the Group.

In relation to the election process, the Chief Executive Officer will first draft a proposal for the election of Executive Officers after consulting with relevant officers as necessary. The Chief Executive Officer will then submit a proposal for the election of Executive Officers to the Board of Directors based on the deliberations and responses to inquiries at a Nomination Committee meeting, and Executive Officers will be elected by resolution of the Board of Directors based on a comprehensive review of the candidates' personal history, achievements, specialist knowledge, and other capabilities.

In addition, if any event occurs that makes an Executive Officer highly ineligible in light of these standards, the Executive Officer shall be dismissed by resolution of the Board of Directors following a review by the Nomination Committee.

Analysis and evaluation of the effectiveness of the Board of Directors

The Company analyzes and evaluates the effectiveness of the Board of Directors based on the evaluation by each Director on an annual basis. In the fiscal year ended March 2025, the Company evaluated the effectiveness of the Board of Directors using a third-party organization (since the fiscal year ended March 2022, a third-party evaluation has been required to be conducted once every three years).

The evaluation method and a summary of the results are outlined below.

- Method of analysis/evaluation

- Evaluation process

- - September 2024 / The materials and minutes of the Company's Board of Directors meetings were disclosed to the third-party organization.

- - September 2024 / The third-party organization conducted a preliminary interview with the Chair of the Board of Directors and the Chief Executive Officer regarding the current state of the Board of Directors.

- - September 2024 / The third-party organization observed the Company's Board of Directors meeting.

- - November 2024 / A questionnaire, prepared in consultation with the third-party organization, was distributed to all 11 Directors, and responses were retrieved on an unsigned form.

- - December 2024 / Based on the results of the questionnaire responses, the third-party organization conducted individual interviews with all 11 Directors regarding important issues related to the Board of Directors.

- - February 2025 / The third-party organization compiled and analyzed the results of the questionnaire and interview responses, and the Directors discussed the effectiveness of the Board of Directors based on the report from the third-party organization.

- - March 2025 / Following the discussions in February, the Board of Directors passed a resolution on the effectiveness of the Board of Directors for FYE March 2025.

- Questionnaire items

The questionnaire uses a four-grade evaluation for the questions below (1. Strongly agree, 2. Agree, 3. Disagree, 4. Totally disagree) and provides a free comment space where needed.

- - The Company's management issues and risks

- - Roles and functions of the Board of Directors

- - Scale and composition of the Board of Directors

- - Status of operations of the Board of Directors

- - Discussions at the Board of Directors meetings

- - Composition, roles and status of operations of each of the Nomination Committee, Audit Committee, Remuneration Committee, and Sustainability Committee

- - Support system for Outside Directors

- - Relationship with investors and shareholders

- - The Company's governance structure and the overall effectiveness of the Board of Directors

- - Self-evaluation

- Interview items

Based on the responses to the questionnaire, interviews were conducted by the third-party organization regarding the following key items related to the effectiveness of the Board of Directors.

- (i) Evaluation of business and management

Evaluation of progress in the Medium-term Management Strategy, the Company's competitive advantage, organizational structure and corporate culture, discussions on medium- to long-term growth, individual issues (group governance/ internal control, human capital, penetration/utilization of ROIC, DX strategy, etc.), etc. - (ii) Evaluation of the Board of Directors

Evaluation of explanatory materials/agenda setting/board operation, attributes of the Chair of the Board of Directors, establishment of the Lead Outside Director, roles/functions of the Board of Directors, expected roles and current status of Outside Directors, composition of Outside Directors and Inside Directors, etc. - (iii) Evaluation of Nomination, Audit, Remuneration, and Sustainability Committees

Evaluation of the composition, role, operation, etc. of each committee

- (i) Evaluation of business and management

- Evaluation process

- Status of initiatives concerning the issues for improvement for FYE March 2025 based on FYE March 2024 evaluation

There was an evaluation of initiatives concerning the following matters taken for further improvement by the Board of Directors in the fiscal year ended March 2025 based on the results of the evaluation of the effectiveness of the Board of Directors in the fiscal year ended March 2024. It was confirmed that although "improvements have been made" in general, "initiatives were not adequate" for a certain matter.

- Development of core management talent

- - Received explanations from the executive side on the succession plan for Executive Officers and Next-Generation Leadership Talent Development Program and held discussions primarily on the following points.

- - Diversification of successor talent pool

- - Increase in the number and ratio of candidates selected for the Next-Generation Leadership Talent Development Program among candidates for Executive Officer successors

- - Strengthening the linkage between the Next-Generation Leadership Talent Development Program and HR measures such as promotion and selection

- - Early identification and planned stretch assignment of the Next-Generation Leadership Talent at the managerial and junior levels

- - The results of the questionnaire showed that less than half of the Directors, five (5) of 11 Directors, responded that "further discussion is needed" regarding the development of the Next-Generation Leadership Talent. Regarding the CEO Succession Plan, when asked the question, "Do you think that sufficient discussions are held at the Board of Directors and committee meetings, and that the current situation is appropriate?" four (4) of 11 Directors answered "Strongly agree" and three (3) responded "Agree," indicating that the positive responses exceeded the negative responses.

- Medium- to long-term competitive advantage of the Company

- - In order to further deepen examination and discussion among the Directors on the medium- to long-term competitive advantage of the Company, we first received multiple explanations from the executive side on the competitive advantage of each business and engaged in discussions.

- - However, according to the questionnaire result, when asked the question, "Do you think that the Company's long-term competitive advantage is sufficiently communicated to investors and shareholders to enhance the Company's presence in the capital markets?" 10 of 11 Directors answered "Disagree," and one (1) responded "Agree," indicating that most responses were negative.

- - In the interview, the following opinions were expressed: "We should determine the competitive advantage of our business and formulate and execute a growth strategy for our business"; and "I don't think we are in a position to adequately analyze and discuss the Company's medium- to long-term competitive advantage within the Company."

- Improvement of the Board of Directors' management

To further improve the management of the Board of Directors, the following initiatives were undertaken.

- - We have reviewed matters to be discussed by the Board of Directors and monetary criteria to further improve the appropriateness of matters to be discussed by the Board of Directors.

- - The following comments were noted in the questionnaire and interviews: "More focus should be placed on important issues"; and "It is good to have a variety of opinions from Directors, but in many cases, opinions are merely presented. It is not necessary to consolidate opinions, but it would be better to discuss how they feel about different opinions."

- Development of core management talent

- Analysis results of the questionnaire and interviews conducted by the third-party organization

The main analysis results of the questionnaire and interviews conducted by the third-party organization are as follows.

- Summary of questionnaire response results

The Board of Directors is highly regarded for its active discussions with appropriately constituted members. Among the 50 questions described in 1.(2) of the questionnaire using a four-grade evaluation, the majority of responses to 48 questions were positive ("Strongly agree" or "Agree"). Questions where negative responses ("Disagree" or "Totally disagree") constituted the majority were limited. It is considered necessary to further evolve the nature of the Board of Directors in the future, for example, by further deepening discussions on medium- to long-term management issues. - Summary of interview response results

In the current situation where the targets of the Medium-term Management Strategy and actual results diverge, it is considered an issue that an appropriate sense of crisis has not been shared. It has been pointed out that the background to this issue includes factors such as "lack of discussion on competitive advantage," "business structure that is easily influenced by market conditions," and "passive corporate culture." With an appropriate sense of crisis shared throughout the Group, the Board of Directors is expected to engage in further discussions aimed at medium- to long-term growth.

- Summary of questionnaire response results

- Summary of FYE March 2025 evaluation results

As a result of deliberations by the Board of Directors, it was confirmed that the effectiveness of the Board of Directors was secured in the fiscal year ended March 2025. In order to further enhance the effectiveness of the Board of Directors, the following is a summary of the deliberations of the Board of Directors on matters identified through the evaluation as areas where further improvement initiatives will be made in the future.

- Medium- to long-term competitive advantage

- - In Directors' discussions, some Directors noted the following comments: "There is a lack of discussion regarding how the Board of Directors itself perceives competitive advantage"; "The Board of Directors should not only express Directors' own views to the executive side but should also discuss 'how to change the situation' more in-depth"; and "The Board of Directors may not have sufficiently delved into the content in-depth after listening to the executive side's explanation."

- Operation of the Board of Directors

- - In Directors' discussions, some Directors noted the following comments: "The discussion should be further focused only on important matters"; and "There are situations where it is desirable for the diverse opinions presented by the Board of Directors to the executive side to be consolidated into one as a whole board."

- - It was also suggested that materials and explanations at the Board of Directors meetings should be more concise and precise.

- Medium- to long-term competitive advantage

- Initiatives in FYE March 2026 aimed at further enhancing effectiveness

Based on the results of the assessment of the Board of Directors' effectiveness for the fiscal year ended March 2025, the initiatives our Board of Directors will undertake to enhance its effectiveness in the fiscal year ending March 2026 are as follows:

- Initiatives to address medium- to long-term competitive advantages

Based on discussions among the Directors in the fiscal year ended March 2025, the Board of Directors will develop its business perspective from the standpoint of medium- to long-term competitive advantages (business portfolio, core competencies, profit structure, etc.). Based on this business perspective, it will appropriately oversee and advise the executive side to ensure that the reconsideration of the Medium-term Management Strategy for the fiscal year ending March 2027 and beyond progresses effectively. - Initiatives to improve the operation of the Board of Directors

To operate meetings of the Board of Directors and briefings for Directors more effectively, we will consider taking the following measures.- - Review agenda items for meetings of the Board of Directors

- - Enhance facilitation during meetings of the Board of Directors and briefings for Directors

- - Consolidate opinions from the Board of Directors and appropriately communicate them to the executive side

- Initiatives to address medium- to long-term competitive advantages

The Board of Directors will keep making efforts to improve the effectiveness toward future.

Policy on Determining of Remuneration for Officers

With the aim of creating an attractive remuneration system for outstanding management personnel that will drive improvements in the Group's corporate value from a medium- to long-term viewpoint and establishing remuneration governance that will enable the Company to fulfill its accountability to stakeholders, including shareholders, the Company shall establish a policy on determining the remuneration for Directors and Executive Officers (hereinafter, "Officers") and a remuneration system as follows:

- Policy on Determining Remuneration for Officers

- (1) A system shall be created that provides competitive standards for remuneration compared with companies of a business category and size similar to the Group.

- (2) The performance of the functions and duties assumed by each Officer and contributions to the improvement of medium- to long-term corporate value shall be evaluated in a fair and equitable manner, and the evaluation results shall be reflected in remuneration.

- (3) As for the remuneration for Executive Officers, in order to have remuneration function as a sound incentive to improve the Group's medium- to long-term corporate value, remuneration shall consist of basic remuneration, an annual bonus based on performance evaluations in each fiscal year, etc. and stock-based compensation, which is a medium- to long-term incentive linked to medium- to long-term performance and corporate value. The remuneration composition ratio shall be determined appropriately in accordance with one's job position. As for the remuneration for Directors (excluding those who concurrently hold the posts of Director and Executive Officer), in principle, only basic remuneration shall be paid in cash, in light of their function and role of supervising the performance of job duties by the Executive Officers. However, Directors, who serve as Chair of the Board of Directors or Chair of each committee shall be paid an allowance in addition to their basic remuneration in consideration of their responsibilities. Further, Directors who are responsible for specific audit-related duties, such as the Chair of the Audit Committee, shall be paid an allowance for audit-related duties commensurate with the burden of their duties.

- (4) An annual bonus shall be determined with the emphasis on the performance in each fiscal year, while appropriately evaluating the relative results of Total Shareholder Return (TSR)* and the status of each Executive Officer's implementation of medium- to long-term management strategies, etc.

*TSR = Average closing price of the stock on each day in March of the current year + Total amount of dividends per share in the current fiscal year Average closing price of the stock on each day in March of the previous year - (5) A medium- to long-term incentive shall be stock-based compensation that enables Executive Officers to share awareness of profits with shareholders in order to enhance corporate value from a medium- to long-term viewpoint.

- (6) The policies for determining remuneration and the amount of individual remuneration shall be deliberated and determined by the Remuneration Committee composed of a majority of Independent Outside Directors.

- (7) Necessary information shall be disclosed actively so that stakeholders including shareholders can monitor the relationship between performance, etc. and remuneration.

- Remuneration System for Officers

- (1) Directors (excluding those who concurrently hold the posts of Director and Executive Officer)

The remuneration system for Directors shall be, in principle, only basic remuneration paid in cash. However, Directors, etc. who serve as Chair of the Board of Directors or Chair of each committee shall be paid an allowance in addition to their basic remuneration in consideration of their responsibilities. The amount shall be determined, referring to the standards for remuneration of other companies based on the research of outside experts. - (2) Executive Officers

The remuneration payable to Executive Officers shall consist of basic remuneration, which is fixed remuneration, and an annual bonus and stock-based compensation, which are performance-linked remuneration. The remuneration composition ratio shall be in line with "Basic remuneration/Annual bonus/Stock-based compensation = 1.0/0.6/0.4" (*In the case where the annual bonus payment rate is 100%) as to the Chief Executive Officer, and for other Executive Officers, the ratio of performance-linked remuneration to basic remuneration shall be set lower than that for the Chief Executive Officer.

Further, the standards for remuneration shall be determined by referring to the standards of peer companies (similar-sized companies determined by the Remuneration Committee) based on the research of outside experts.

<Basic Remuneration>

Basic remuneration shall be paid in cash as fixed remuneration in accordance with one's job position.<Annual Bonus (Short-term Incentive Remuneration)>

The annual bonus shall be determined based on the consolidated operating profit, relative comparison of TSR, and status of achievement of the non-financial target set for each Executive Officer, on a single-year basis.

The specific evaluation items shall be as follows:«Evaluation Items»

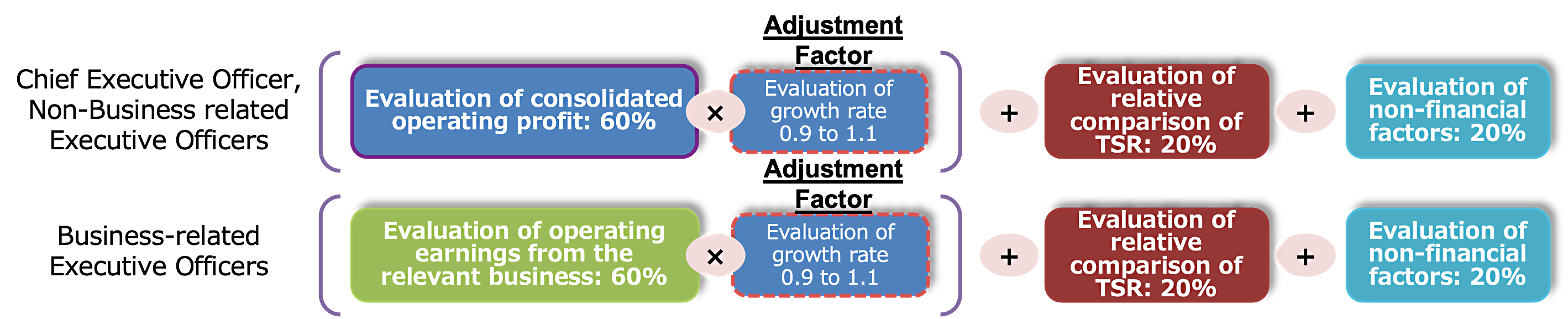

- (i) Evaluation based on consolidated operating profit, which measures the earning capacity of the Company's main business (or, in the case of an Executive Officer in charge of business activities, operating earnings from the relevant business sector);

The consolidated operating profit evaluation factor is to be multiplied by an adjustment factor based on the consolidated operating profit growth rate compared with other companies to enhance consciousness on growth greater than market growth (relative comparison with six domestic nonferrous metal companies and the companies chosen mainly among similar-sized domestic manufacturing companies) - (ii) Relative comparison of TSR (relative comparison with six domestic nonferrous metal companies and the companies chosen mainly among similar-sized domestic manufacturing companies)

- (iii) Non-financial evaluation that evaluates the status of achievement of the targets set for each Executive Officer at the beginning of the term and other relevant factors with regard to efforts aimed at improving medium- to long-term corporate value, which is less likely to be represented in short-term performance, as well as efforts in line with the Sustainability Policy*

(*)Sustainability Policy Items- 1. Build a Work Environment that puts Safety and Health First

- 2. Respect Human Rights

- 3. Promote Diversity, Equity and Inclusion

- 4. Cultivate Mutual Prosperity with Stakeholders

- 5. Strengthen Corporate Governance and Risk Management

- 6. Engage in Fair Business Transactions and Responsible Sourcing

- 7. Ensure Stable Provision of Safe, Secure, and High Value Added Products

- 8. Proactive Engagement for the Global Environment

«Calculation Formula»

By deeming the amount payable for achievement of the target (Base Annual Bonus) as 100%, the amount for each individual shall be calculated by using the following calculation formula:Annual Bonus = Base Annual Bonus by Job Position × Payment Rate Based on Performance Evaluation*

*"Payment Rate Based on Performance Evaluation" shall range from 0% to approx. 200% based on a performance.

«Evaluation Weight»

The annual bonus shall be determined based on the evaluations of each portion of 60%*, 20% and 20% of the base annual bonus amount, which depends on one's job position, in terms of consolidated operating profit evaluation (or, in the case of an Executive Officer in charge of business activities, operating earnings evaluation from the relevant business sector), relative TSR comparison and non-financial factors, respectively.

* To be adjusted using consolidated operating profit growth rate compared with other companies.«Target of consolidated operating profit for annual bonus»

With regard to the target of consolidated operating profit for annual bonuses, in principle, consolidated operating profit for the current period planned in the Medium-term Management Strategy shall be applied (For operating earnings of the business for which the Executive Officer is responsible, planned consolidated operating earnings from the relevant business sector shall be used.).«Stock-based compensation (Medium- to Long-term Incentive Remuneration)*»

Stock-based compensation shall be a system that utilizes a trust for the purpose of achieving the sharing of a common profit awareness with shareholders. This shall be used as an incentive for improving the medium- to long-term corporate value of the Group and under which the Company's common shares and cash equivalent to the proceeds from the realization of the Company's common shares (hereinafter referred to as "the Company's Stock, etc.") shall be granted in accordance with one's job position, upon retirement from the post of Executive Officers. No performance conditions nor stock price conditions shall be set with respect to the shares to be delivered.

Please note that in the case of a non-resident staying in Japan, different treatment may be applied under laws or for any other relevant circumstances.* The Officers' remuneration system adopts a structure called BIP (Board Incentive Plan) and grants to the Executive Officers the shares of the Company's Stock, etc. During the trust period, it is an incentive plan to accumulate points to be given to Executive Officers, and to grant the shares of the Company's common stock equivalent to 70% of such accumulated points (shares less than one unit shall be disregarded) and cash equivalent to realized value of the shares of the Company's common stock equivalent to the remaining accumulated points as compensation to Executive Officers after their retirement. One point is deemed equal to one share of the Company's common stock, and if a stock split or reverse stock split occurs during the trust period, the number of the Company's shares per point shall be adjusted according to the stock split ratio or reverse stock split ratio of the Company's shares. The maximum number of points to be given to Executive Officers during the three fiscal years including current fiscal year (from the fiscal year ended March 2024 to the fiscal year ending March 2026) shall be 140,000 points in total.

- (1) Directors (excluding those who concurrently hold the posts of Director and Executive Officer)

<Claim for return of remuneration, etc. (Malus and Clawback System)>

If an Executive Officer violates laws and regulations or the duty of care of a good manager, the Company may, upon resolution of the Remuneration Committee, revoke the right to receive an annual bonus or demand that the Executive Officer return the bonus after it has been paid, and revoke the right to receive the shares of the Company's Stock, etc. or demand the return of an amount equivalent to the accumulated number of points.

Status of Audits

(Status of audits performed by the Audit Committee)

In addition to attending meetings of the Strategic Management Committee and other important meetings, by making use of a method via the internet at the same time, members of the Audit Committee conduct interviews with Directors, Executive Officers, departments in charge of internal audits, and other departments in charge of internal control concerning progress on the execution of their duties, and view important approval documentation, etc. Selected members of the Audit Committee investigate the state of business and assets at the Company headquarters and important business sites according to the audit standards and audit plans, etc. of the Audit Committee as established by the Audit Committee.

They also conduct onsite audits of Group Companies, etc. as needed, while forming a framework for conducting audits on the state of the execution of duties by Directors and Executive Officers.

In addition, the Audit Committee holds regular meetings with major Group Companies' Auditors as part of efforts to strengthen coordination in order to enhance the effectiveness of the Group's audit systems. The Audit Committee Office has been set up directly under the Audit Committee to assist the Committee's duties.

Kazuhiko Takeda, Chair of the Audit Committee, has extensive knowledge of finance and accounting through his experience as CFO at major subsidiaries of listed companies.

The Chair of the Audit Committee attends important meetings such as the Strategic Management Committee, the Group's Management Committee, Beginning-of-Year Performance Forecast Deliberation, Monozukuri and R&D Strategy Meetings and the Sustainability Deliberative Council, as well as conduct on-site audits of locations both inside and outside Japan, including affiliates, and make comments or suggestions on matters of concern. Regular meetings are also held with the Chief Executive Officer, as well as individual discussions with Executive Officers, to exchange opinions. In addition, they receive reports from each division of the Corporate on a regular or timely basis and make suggestions or recommendations. Details thereof are shared with the Audit Committee in a timely manner.

(Status of internal audits)

As of June 25, 2025, the Internal Audit Div., which is a department in charge of internal audits, consist of 19 persons, including the General Manager of the Internal Audit Div. The Internal Audit Div. is responsible for conducting internal audit work on the instructions of the responsible Executive Officer in cooperation with the Audit Committee to investigate the effectiveness and efficiency of company operations across the Group, the credibility of financial reports, the state of asset preservation and use, the risk management status, and the state of compliance with laws and regulations, and internal rules and standards, based on the internal audit plans approved by the responsible Executive Officer and the Audit Committee. They also share information with and work closely with the Accounting Auditor to conduct audits. The Internal Audit Div. regularly reports the results of Group-wide audits to the responsible Executive Officer and the Audit Committee, and the responsible Executive Officer regularly reports the results of Group-wide audits to the Board of Directors.

(Status of accounting audit)

The Status of accounting audit for the fiscal year ended March 2025 is as follows:

- (1) Name of Audit Corporation

Deloitte Touche Tohmatsu LLC - (2) Continuous audit period

From 2023 (two years) - (3) Certified public accountants who performed accounting audit duties

Designated limited liability partner, Engagement Partner Yukitaka Maruchi

Designated limited liability partner, Engagement Partner Koji Inoue

Designated limited liability partner, Engagement Partner Hiroyuki Fukushima - (4) Composition of assistants for accounting audit duties

Assistants for the accounting audit work of the Company consist of 20 certified public accountants and 69 others. - (5) Policy on appointment, dismissal and non-reappointment

The Audit Committee appoints the Accounting Auditor based on the following criteria: (1) expertise, independence, timeliness and appropriateness, quality control and governance systems, (2) ability to respond to the Company's multi-industry and global business developments, (3) efficiency improvement of accounting audit operations, (4) communication with the Audit Committee, management, etc., (5) any applicability to dismissal requirements based on statutory grounds, and (6) continuous audit period. The Audit Committee's policy is to dismiss or not reappoint if a problem is found in these criteria. - (6) Evaluation of the Accounting Auditor by the Audit Committee

In evaluating the Accounting Auditor, the Audit Committee obtains necessary materials and receives reports from Executive Officers, related departments in the Company, and the Accounting Auditor to make a comprehensive evaluation.